Weird web3 energy

What’s next for the web? I’ve spent a good chunk of my career trying to answer this question in practice, making the web do things it maybe shouldn’t, like mobile operating systems, and VR.

This is a big question, so I’m tackling it in pieces:

In “Why did the web take over desktop and not mobile?”, I try to understand why the web disrupted desktop computing, but not mobile.

In “The state of the web”, I look at the web in 2021, making the web do apps, and the WebAssembly plot twist.

In “Weird web3 energy”, I explore emerging distributed web efforts.

In “Building new weblike things”, I consider how we might build new open systems with weblike characteristics.

Epistemic Status: careful speculation. I can feel a hunch forming, but I’m less confident of my conclusions in this post than in the others.

The landscape of tech is essentially feudal

Each app builds a moat and walls to protect the hoard of data its peasants produce. This is both for reasons of protection, and power. How did this condition emerge?

Before the advent of the internet, apps ran on your computer and saved data to your computer. The internet flipped this around. Web software ran remotely on server computers, and saved data remotely to giant databases.

Now our data was on someone else’s computer. This introduced a host of challenges for anything that required trust. Websites had to roll their own solutions for identity, access control, data protection, and payments. Browsers built walls around websites to protect this valuable data from exfiltration. Websites became the boundary of trust, and apps followed the same model.

New business models built moats to go along with the walls. Payment platforms offered trusted hubs for exchange. SaaS found it could rent software to businesses. Aggregators discovered how to leverage data silos and network effects to monopolize demand and commodify supply.

Privacy and security in this world mostly means “which private company do you trust with your safety?” The answer often coincides with who has the largest walls and deepest moats.

Currency upended feudalism

So how did feudalism end IRL? It’s complicated, but my sense is that part of the answer has to include money. By the 1400s, the muddy transition from Feudalism to The Renaissance was underway, with art, science, trade, and protocapitalism all booming. The popularization of double-entry bookkeeping enabled money to flow at scale.

Another word for money is “currency”, as in “currents”, as in “river”. This term emphasizes something important about money: it has to flow to exist at all. Money is a protocol, a shared idea that has power to the extent that people participate in exchanging it.

Under feudalism, power accumulated around fixed objects. A house, a horse, a hereditary holding. At some point, though, the flow of money eroded away the power of the underlying object. Capital could pass through castle walls. Power began to migrate toward businesses and banks. The shape of the the physical world began to rearrange itself around money.

If networked software is feudal, what is its Renaissance?

Weird Web3 energy

The dominant business models of software are predicated on moats and walls. What might invert this feudal logic?

A weird energy has been building up around the term “web3”. This is a catch-all for everything from p2p, to cryptocurrencies, fat protocols, smart contracts, NFTs, and a bunch of other things besides.

NFTs have recently drawn a rush of speculative capital, but all sorts of unusual experiments are being brewed up around this scene:

What if we replaced http with p2p?

What if we paid everyone to participate in a distributed server farm?

What if we ran apps on blockchains instead of servers?

What if we inverted the ownership model of media?

What if we created co-owned digital platforms?

What if we built self-funding protocols?

What if we paid each other to work on open source software?

What if we replaced organizations with smart contracts?

What if we issued fractional stock on everything?

What if we replaced corporations with currencies?

What if we tokenized natural assets?

What if we designed RPG items and waited for a game to emerge?

How much of this is speculative, in both senses? How much of it is a bubble? A lot, probably, and yet…

Capital bubbles fund infrastructure deployment

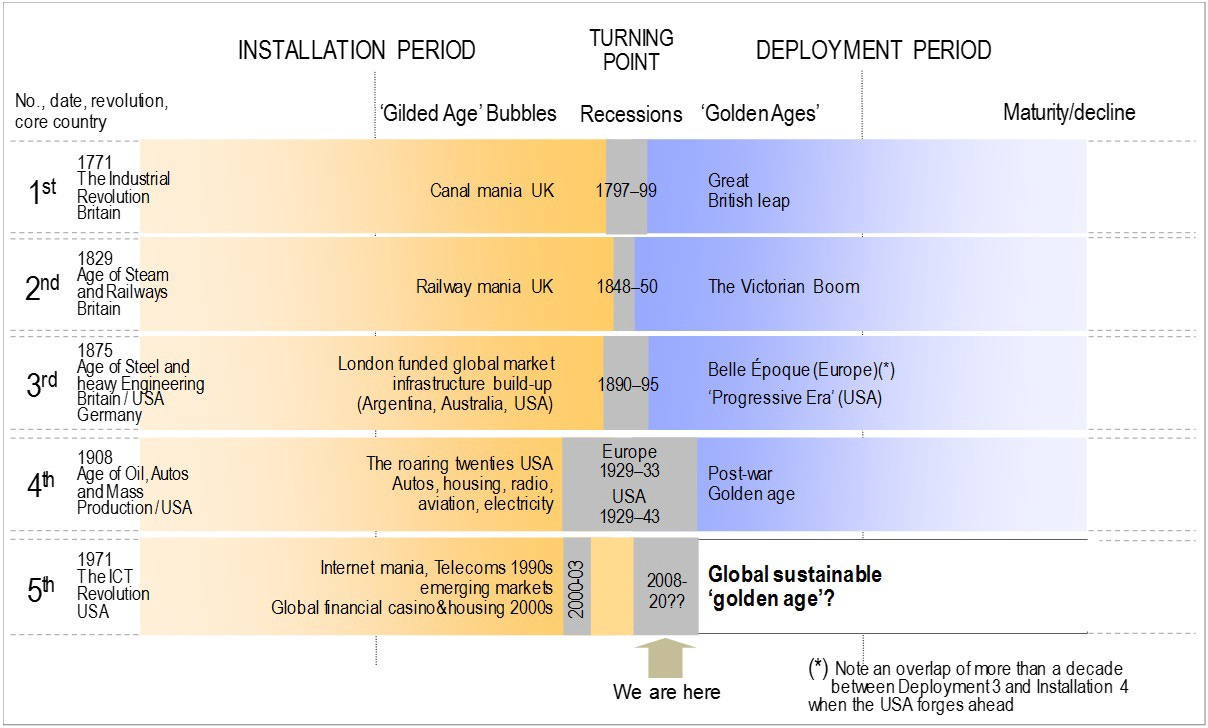

In her landmark book, “Technological Revolutions and Financial Capital”, economist Carlota Perez analyzes the history of major technological revolutions and finds that speculative financial bubbles have a key role to play in the successful deployment of new technologies.

Perez identifies 5 historical technological waves. Each wave is powered by the introduction of a new low-cost input: coal and iron for the railway age, steel for the heavy engineering age, electricity, oil, and plastic for the mass production age, microchips for the ICT age.

By the time the new input is unlocked by some technological breakthrough, the previous technological paradigm has already run dry, leaving speculative capital desperate for returns. Sensing the immense promise of the new technological paradigm, and smelling profits, investors begin flooding the space with capital, leading to a boom, a bubble, and a bust.

But the crash leaves something important behind: infrastructure. Bubbles fund the deployment of canals, factories, railroads, shipyards, highways, electrical grids, cellular towers, broadband. This infrastructure becomes the foundation around which society rebuilds itself after the crash.

So, are cryptocurrency, NFTs, and web3 a bubble? And if so, what kinds of durable infrastructure might this bubble leave behind?

Is web3 disruptive?

It seems telling that so many efforts to reform the web bottom out at payments and identity.

Payments and identity require consensus.

Payments and identity require a high degree of trust.

Payments and identity produce preferential attachment, through the Mathew Effect (rich-get-richer), and Network Effect, respectively.

Payments and identity are attractors for wealth, power, centralization, and all the problems that come along with those things.

Aggregators emerged at the intersection of these attractors, and broke the evolutionary loop of technology, leveraging network effects to fend off componentization and freeze the evolutionary landscape in place.

Now into this mix comes web3 and cryptocurrency, injecting weird randomizing energy into precisely these parts of the system.

Aggregators are incentivized to limit composability. By contrast, the value of a web3 token may actually increase when composed with other systems. The money flowing through web3 is mediated by open source smart contracts, rather than closed source software owned by corporations. This feels completely asymmetric. I cannot imagine a Facebook or Google being able to absorb fat protocols or distributed apps.

It’s interesting, also, how NFTs have created a whole new product-market fit for IPFS and FileCoin. If you’re going to spend large amounts to acquire an authentic certificate of ownership, you better make sure you have a permanent place to store it. IPFS benefiting from NFTs feels like a clear example of bubble money funding infrastructure. After all, you can’t have a distributed internet without distributed protocols.

Perhaps we are even bootstrapping distributed DNS without being aware of it?

Part of me knows, absent some form of progressive taxation, network effects will always aggregate a network, resulting in steep power law distributions, whether it starts decentralized or not. So maybe this is just going to shake up the pieces on the board, but that can be ecologically valuable as well.

Eldritch emergence

I think my read of this whole thing right now is eldritch, rather than utopian. Complex distributed systems, like the web, markets, society, ecosystems, biology, are emergent. Emergence is powerful, resilient, unmoral, teleonomic.

Sometimes we might find our ideological project pushes for one thing, while the emergent effects of our ideological project produce another thing, even an antithesis.

We are stuck, alas, with Leviathan, and the challenge is to tame it. That challenge may well be beyond our reach.

James C. Scott

Faced with this dilemma, we find ourselves ecologists. Entangling ourselves with complex systems, and co-evolving with them has become our human condition. They are often critical to our survival, but they don’t care about our survival, (and we often don’t care enough about their survival). We can’t control them, but maybe we can garden them? An evolutionary system will always primarily exist for its own furthering, but perhaps we can find spaces for mutualism?